Mortgage Action Alliance (MAA)

The

Mortgage Action Alliance, Inc.® (MAA) is a voluntary, non-partisan and free nationwide grassroots lobbying network for real estate finance industry professionals, affiliated with the Mortgage Bankers Association (MBA). We are dedicated to strengthening

the industry's voice and lobbying power in Washington, DC and state capitals across America.

The

Mortgage Action Alliance, Inc.® (MAA) is a voluntary, non-partisan and free nationwide grassroots lobbying network for real estate finance industry professionals, affiliated with the Mortgage Bankers Association (MBA). We are dedicated to strengthening

the industry's voice and lobbying power in Washington, DC and state capitals across America.

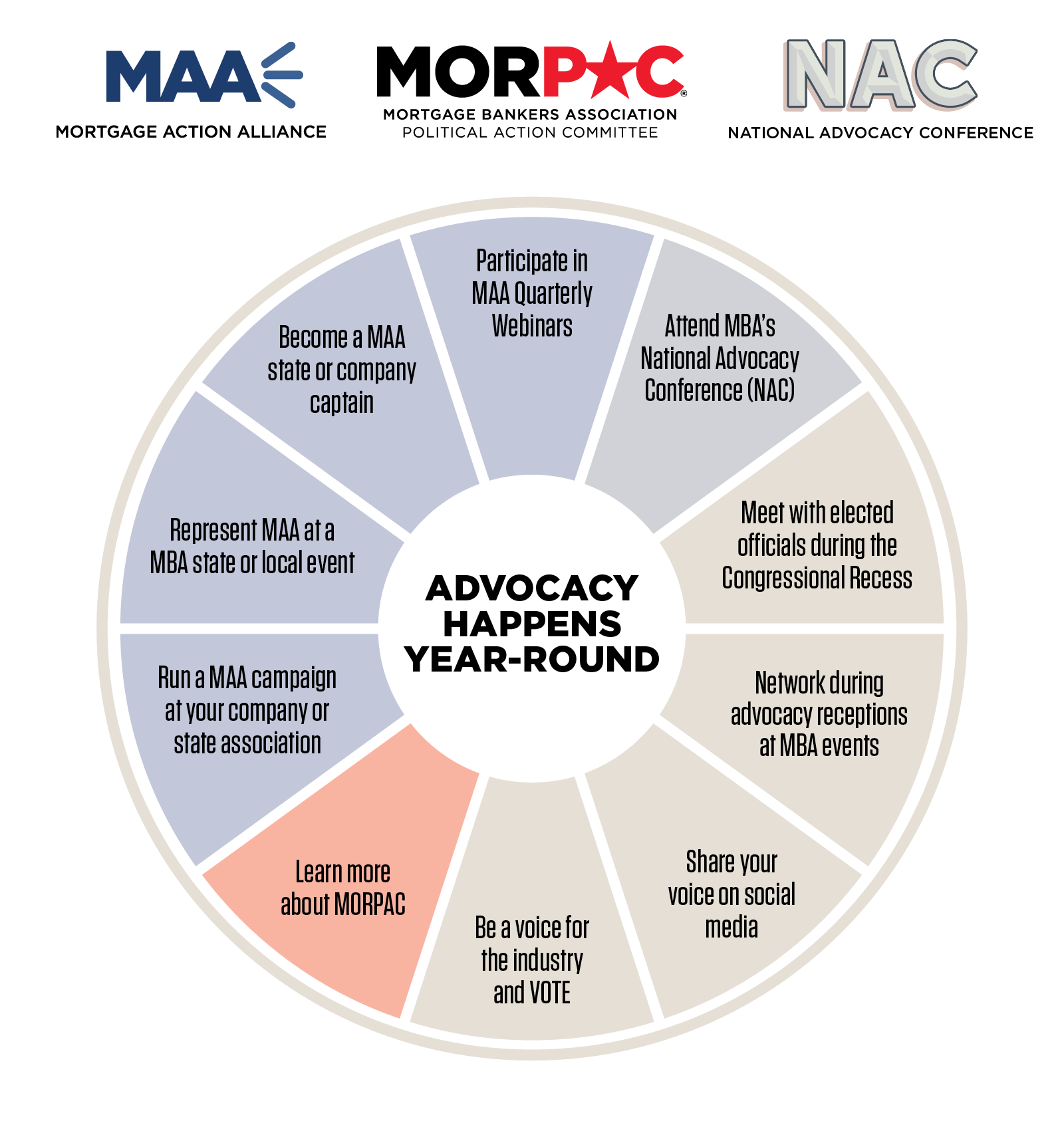

Join MAA to play an active role in how laws and regulations that affect the industry and consumers are created and carried out by lobbying and building relationships with policymakers. It only takes a moment to get started, and you do not have to be a member of MBA to enroll.

You Make Advocacy Happen!