Commercial/Multifamily Research

Data. Analysis. Insights. MBA Research adds value to your business. MBA's highly regarded research and economics group provides the commercial real estate finance (CREF) industry's most current and comprehensive data and benchmarking tools that make a difference in short- and long-term strategic planning. For additional information, contact us at [email protected].

From the CREF Market Intelligence Blog

-

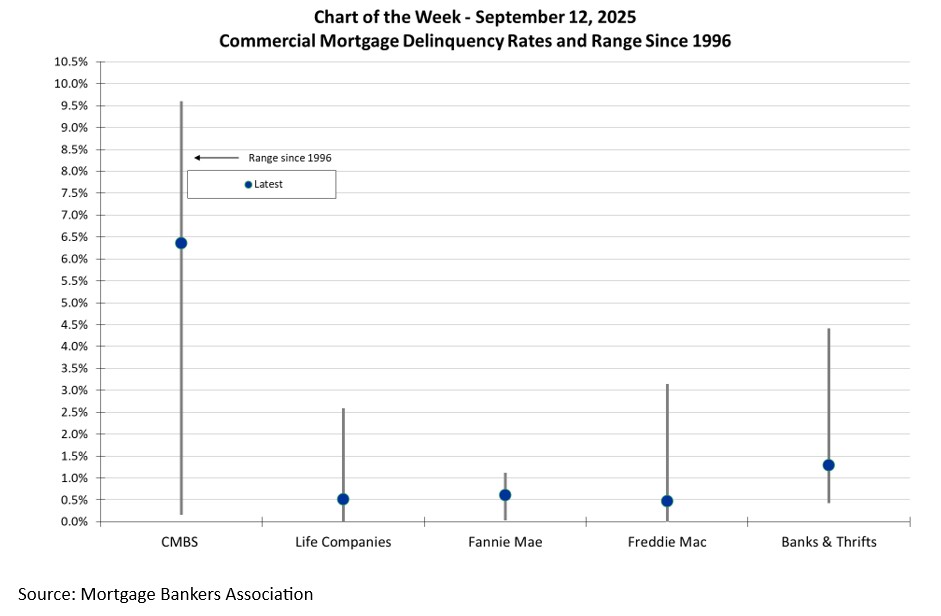

Chart of the Week: Commercial Mortgage Delinquency Rates and Range Since 1996

Chart of the Week: Commercial Mortgage Delinquency Rates and Range Since 1996Commercial mortgage delinquencies rose in the most recent quarter, with increases recorded across most major capital sources. While the specific drivers vary by loan type and property sector, the trend underscores continued stress in commercial real estate, particularly within office and multifamily.

-

Chart of the Week: Total Commercial Real Estate lending, 2020-2024

Chart of the Week: Total Commercial Real Estate lending, 2020-2024From 2020 to 2024, commercial and multifamily mortgage originations experienced notable shifts across investor types. The market peaked in 2021, driven by heightened activity across nearly all sectors, before experiencing a sharp decline in 2023. A modest rebound followed in 2024.

Forecasts, Commentary and Database

Originations

Servicing and Mortgage Debt Outstanding

Benchmarking Studies

Peer Business Roundtables

MBA's Peer Business Roundtables (PBRs) bring together professionals from commercial and multifamily real estate finance firms to meet their peers, hear from experts and share experiences and best practices. MBA's PBRs keep participants up to date with industry trends and practices and provide unparalleled networking opportunities. Learn more to participate in one of the following PBRs: Human Resources, Financial Officers, Technology Officers, and Marketing Officers.

Participate in an MBA Survey

Your participation helps the industry succeed. Learn how you and your company can be a part of the big picture by participating in one or more of the many surveys conducted by MBA. Learn more.