School of Mortgage Banking III

Master Long-Term Strategy: Ready to take your mortgage banking career to the next level? Our School of Mortgage Banking III is the culminating course for mastering long-term strategic planning within the mortgage banking industry.

Key benefits include:

- Hands-on experience: Develop practical skills in planning and forecasting future business operations.

- Leadership development: Practice effective management of diverse teams and personalities.

- Real-world simulation: Compete against other teams to create a winning strategy for a simulated company, facing various economic conditions.

- Presentation skills: Showcase your strategy, business plan, and results to the Board of Directors.

Upcoming School of Mortgage Banking III Courses

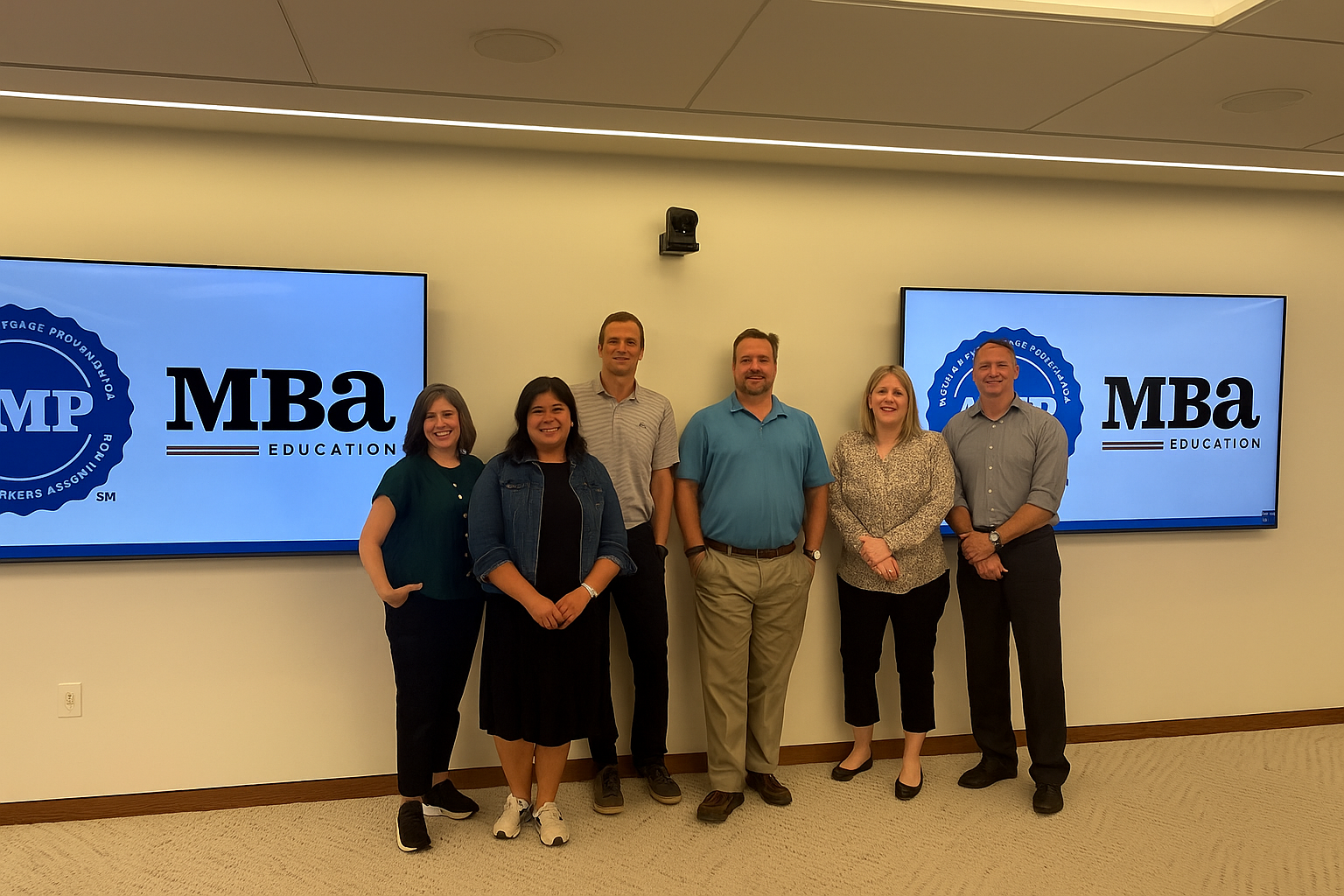

Meet the latest winning SOMB III team from the August 2025 Class!

Winning Team Members, include:

Kimberly Dawson, AMP, Director of Property and Field Solutions, Fannie Mae

Doug Gibson, AMP, Compliance Manager, Pulte Mortgage

Sandy Knott, AMP, Vice President of Strategic Initiatives, Mr. Cooper

Allen Weinzapfel, AMP, Senior Account Executive, FNF Family of Companies

Lena McCullough, AMP, Director of Contract Underwriting, National MI

Adam Rivera, AMP, Change Champion Mortgage Lending, The Huntington National Bank

Each SOMB III winning team showcases strong strategic and financial acumen, collaborative mortgage finance expertise, and outstanding presentation skills. Congrats to our winners and the glory of rising to the top, and best of luck in your professional journey. Will you be on the next winning team?!

The Details

Course Level: Advanced

Course Delivery Method: Classroom or Online Course

Duration of Classroom Course: Four days

Duration of Online Course: 13

two and a half hours sessions held over three consecutive weeks

Elements: Case Study, Final Exam, Discussion Boards/Forums, Group Assignment/Activities, Student Presentations

What is needed to

enroll in SOMB III?

- If pursuing the AMP designation, students need to have a passing grade of 75% or greater on both the SOMB I & SOMB II final exams.

- If not pursuing the AMP designation, students need to have taken SOMB II and passed the final exam with 75% or greater.

There are no exemptions from SOMB III.

CMB Certification Credit

Upon successful completion of this course, you will earn 30 points toward your Certified Mortgage Banker (CMB) designation.

AMP Designation Credit

Professionals who complete all three SOMB courses will receive their Accredited Mortgage Professional (AMP) designation.

Corporate Training Solutions

We have many new solutions that can be widely applied across your business. Explore our corporate training offerings or contact us at (800) 793-6222 (select option 2) or [email protected] to learn more.

Willis Bryant Award

The Willis Bryant Award recognizes scholastic achievement and leadership qualities displayed throughout all three SOMB course levels. View past winners and learn more.