Commercial/Multifamily Market Intelligence Blog

-

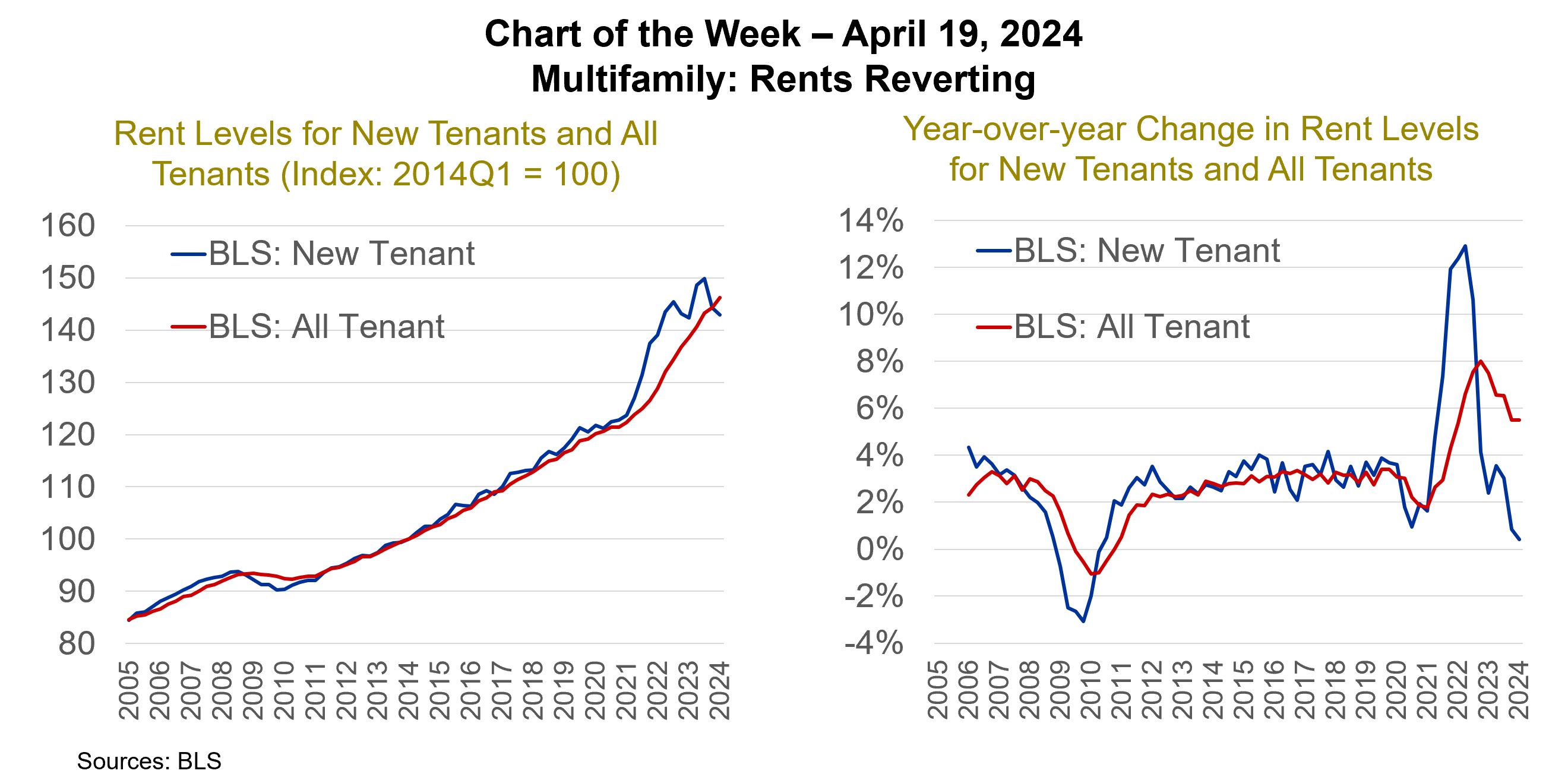

Chart of the Week: Multifamily - Rents Reverting

Chart of the Week: Multifamily - Rents RevertingThe pandemic did a number on the housing market. Rental markets were already stretched from years of underdevelopment that followed the Great Financial Crisis, while a surge of Millennials was just entering their formative renting years. The result was falling multifamily vacancy rates, which dropped from an all-time high of 13.1 percent at the end of 2009 to 7.0 percent at the end of 2015. Rents followed suit, rising steadily between 2 and 4 percent per year from 2012 to 2020.

-

2023 Q4 Databook

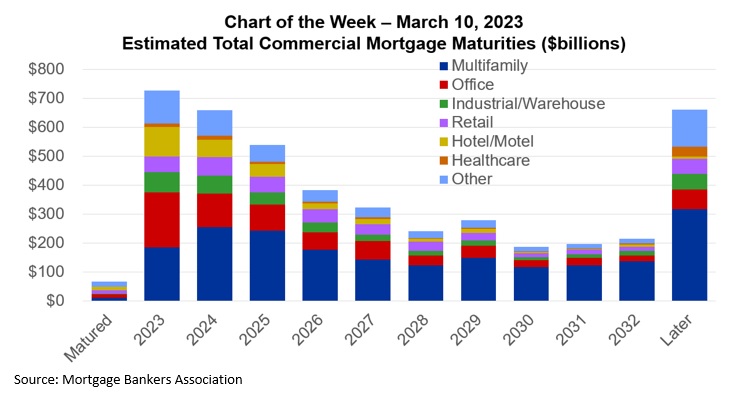

Long-term interest rates have come down from their highs of last year, which should provide some relief to some loans, but many properties and loans still face higher rates, uncertainty about property values and – for some properties – changes in fundamentals. Each loan and property faces a different set of circumstances, which will come into play as the market works through loans that mature this year.

-

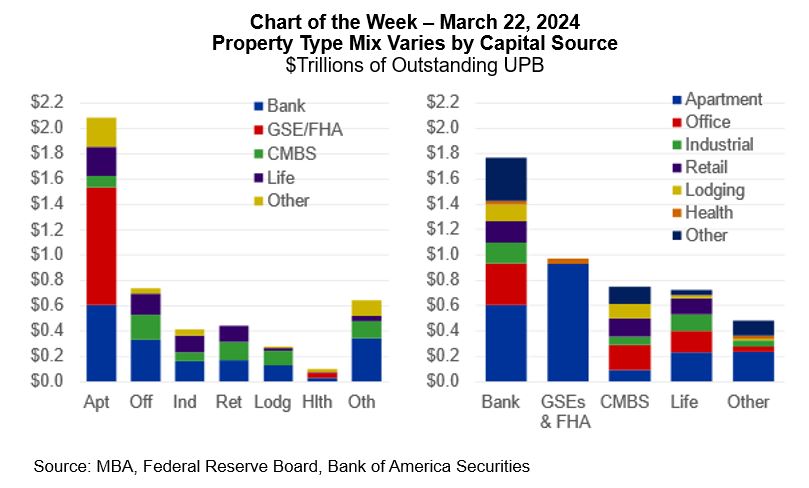

Chart of the Week: Property Type Mix Varies by Capital Source

Chart of the Week: Property Type Mix Varies by Capital SourceCRE mortgage debt is not a monolithic market. Rather, it is made up of a broad range of intersections—across property types and capital sources, as well as property subtypes, metro markets and submarkets, owner types, vintages, and more.

-

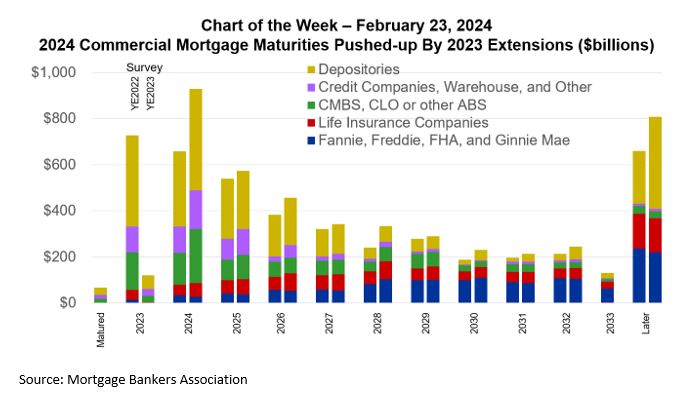

Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 Extensions

Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 ExtensionsA lack of transactions and other activity last year, coupled with built-in extension options and lender and servicer flexibility, has meant that many commercial mortgages that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2026, 2028 or in other coming years.

-

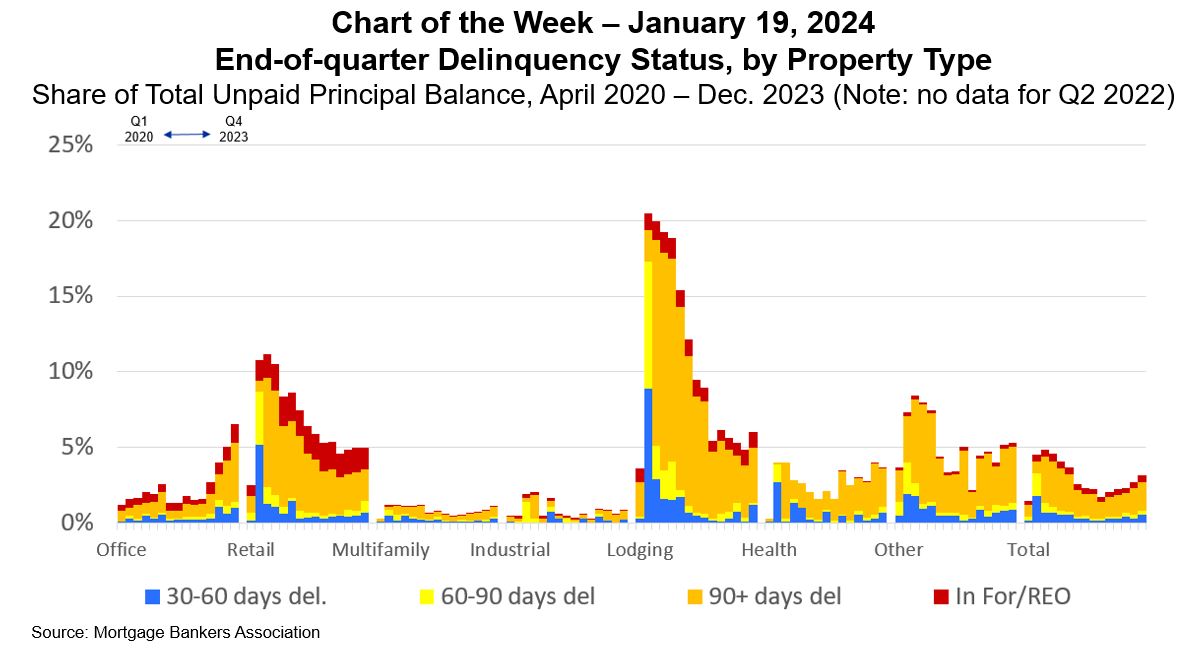

Chart of the Week: End-of-quarter Delinquency Status by Property Type

Chart of the Week: End-of-quarter Delinquency Status by Property TypeOngoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

-

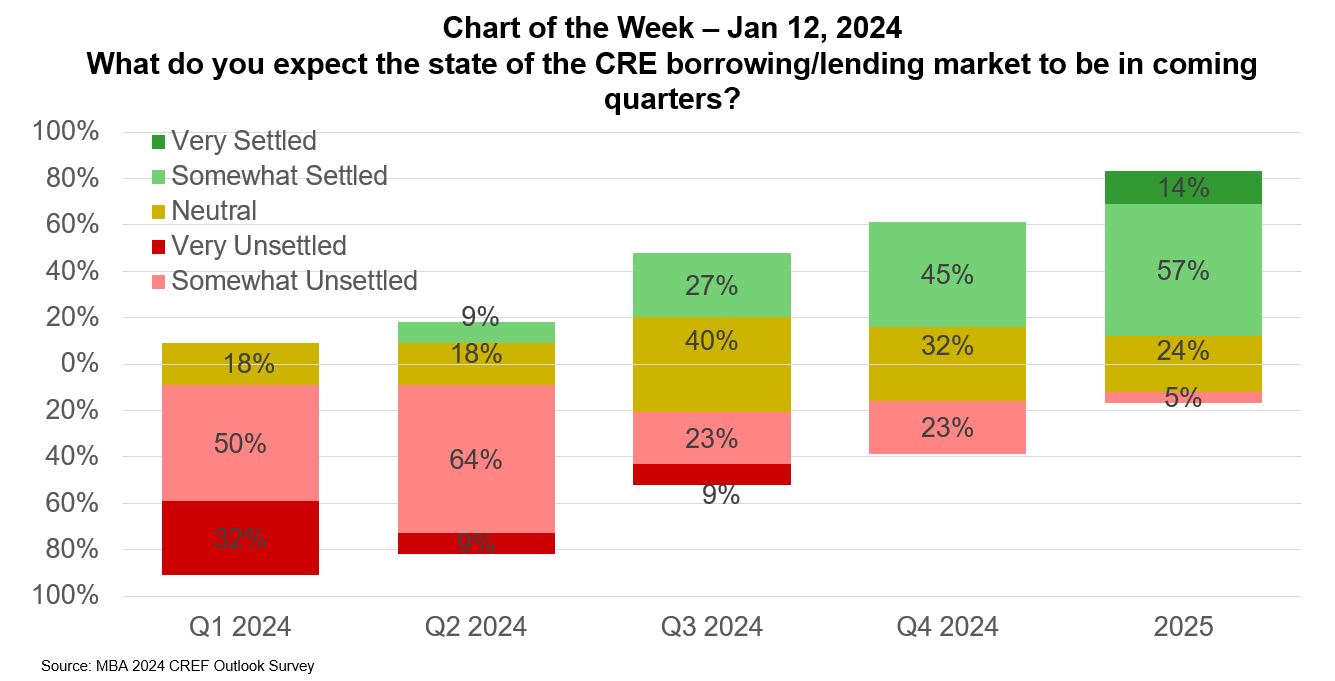

Chart of the Week: What to expect in CRE borrowing/lending

Chart of the Week: What to expect in CRE borrowing/lendingEven though many commercial real estate loans are long-lived, with terms of five, seven, ten, or more years, there’s a sense that the industry starts each year fresh.

-

2023 Q3 Databook

Commercial real estate markets are entering the new year relatively stuck. Through the first three quarters of 2023, property sales and mortgage origination volumes are each down fifty-plus percent compared to the year prior. Questions about some properties’ fundamentals, about where property values sit and about where interest rates may go from here have led to many participants sitting on the sidelines – waiting for greater clarity and perhaps more favorable conditions.

-

Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-insured Firms

Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-insured FirmsSince March of 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate (CRE) are affecting banks and b) how conditions with banks are affecting CRE.

-

2023 Q2 Databook

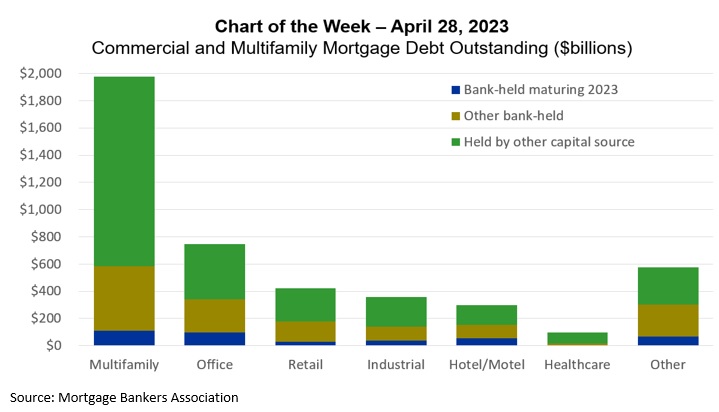

Commercial real estate is a large and heterogeneous market. Of the $4.6 trillion of commercial mortgage debt outstanding, roughly $2 trillion is backed by multifamily properties, $750 billion by office loans, $420 billion by retail, $360 billion by industrial and $300 billion by hotel, with the remainder in health care, self-storage, mixed use, and a host of other income-producing properties.

-

MBA CREF Forecast - July 2023

Higher and volatile interest rates, uncertainty about property values and questions about some property fundamentals have led to an impasse in commercial real estate (CRE) property sales and mortgage originations activity this year.

-

2023 Q1 Databook

The U.S. economy has slowed, but less than many expected, to start 2023. Tighter credit conditions and an inverted yield curve serve as signs that further slowdowns may be ahead.

-

2023 Q1 Mortgage Debt Oustanding

Every quarter, MBA releases an analysis of the amount of commercial and multifamily mortgage debt outstanding (MDO) detailing the total amount of MDO as well as the holdings of different capital sources. For our Q1 2023 release, we urge users to take the numbers with a grain of salt, or two.

-

Chart of the Week: Commercial and Multifamily Mortgage Delinquency Rates

Chart of the Week: Commercial and Multifamily Mortgage Delinquency RatesOngoing stress caused by higher interest rates, uncertainty around property values and questions about fundamentals in some property markets are beginning to show up in commercial mortgage delinquency rates.

-

Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

Chart of the Week: Commercial and Multifamily Mortgage Debt OutstandingTwo questions have dominated the CRE headlines of late: a) the reliance of banks on commercial real estate and b) the reliance of commercial real estate on banks. We addressed the former in a previous Chart of the Week. Here we look at the latter with a particular focus on office—the property type attracting the greatest scrutiny.

-

2022 Q4 Quarterly Databook

There is a great deal of uncertainty about the future path of the U.S. economy, partially driven by -- and partially contributing to -- decisions that will be made by the Federal Reserve. The economy ended 2022 on a strong note, with inflation-adjusted gross domestic product growing at a seasonally adjusted annual rate of 3.2 percent in Q3 and 2.6 percent in Q4. That growth came after declines of 1.6 percent in Q1 and 0.6 percent in Q2, leading to growth of just 0.9 percent for 2022 as a whole.

-

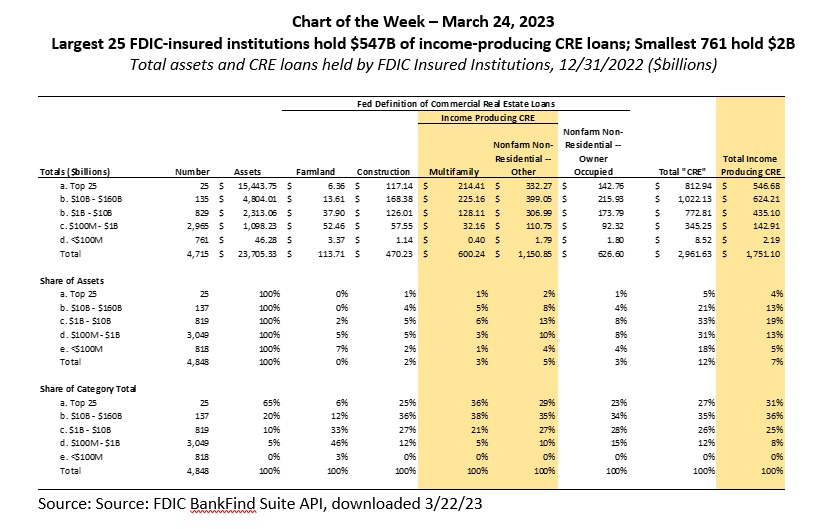

Chart of the Week: Total Assets and CRE Loans held by FDIC-Insured Institutions

Chart of the Week: Total Assets and CRE Loans held by FDIC-Insured InstitutionsMany Federal Reserve data series for CRE include not just loans backed by income-producing CRE (think apartments, office, retail, industrial, and other properties for which owners charge rents for people’s or firm’s use of the space), but also construction and development loans (which includes a large share of loans backing construction of single-family and for-sale homes), loans backed by farmland, and loans collateralized by owner-occupied properties (which are generally C&I loans with the extra protection of real estate but no reliance on rents, leases, and the like). In most MBA data, we try to strip out these other categories to focus on income producing CRE, which is what we think most market participants generally mean when talking about the CRE market.

-

Chart of the Week: Estimated Total Commercial Mortgage Maturities

Chart of the Week: Estimated Total Commercial Mortgage MaturitiesAt MBA’s CREF Convention in San Diego last month, we released the results of our annual survey of upcoming commercial and multifamily mortgage maturities. The survey collects information directly from loan servicers on when the loans they service mature. As in past years, the numbers we released covered loans held by non-bank lenders—including those guaranteed by Fannie Mae, Freddie Mac, and FHA, as well as those held by life companies, included in commercial mortgage-backed securities (CMBS), made by investor-driven lenders like debt-funds, mortgage REITs, and other credit companies. While the information we collect covers essentially all the loans in those groups, it has typically covered only a sample of loans held by banks. This year’s survey, however, collected information on $400 billion of bank-held commercial and multifamily mortgages—23 percent of the outstanding universe. Using this year’s survey results, for the first time we are expanding our loan maturity analysis to include an estimate of the maturity profile of all commercial and multifamily mortgages—including the more than $1.7 trillion on bank balance sheets.

-

MBA CREF Forecast - January 2023

At the end of 2021, the typical (median) member of the Federal Reserve’s Open Market Committee expected the Fed Funds rate to end 2023 at 1.6 percent. In June 2022 that figure had risen to 3.8 percent. In December 2022 it had risen again, to 5.1 percent. Those shifts in outlook from the Fed are both a response to changing economic conditions as well as a cause of change themselves. And commercial real estate markets are not immune to either, with uncertainty – and volatility – around the paths of the economy, interest rates and property valuations all causing significant instability for the market.

-

2022 Q3 Quarterly Databook

The US economy, and thus commercial real estate markets, are facing a period of uncertainty as the Federal Reserve continues to signal it will do everything in its power to bring down inflation. Using short-term rates as their hammer, the Fed is sifting through economic data to try to gauge how high rates will have to go and how long they will have to stay there to tame price growth. Both the Fed and market participants are also working through what damage those actions are likely to cause to the economy. The impacts on commercial real estate markets are likely only beginning to show up.

-

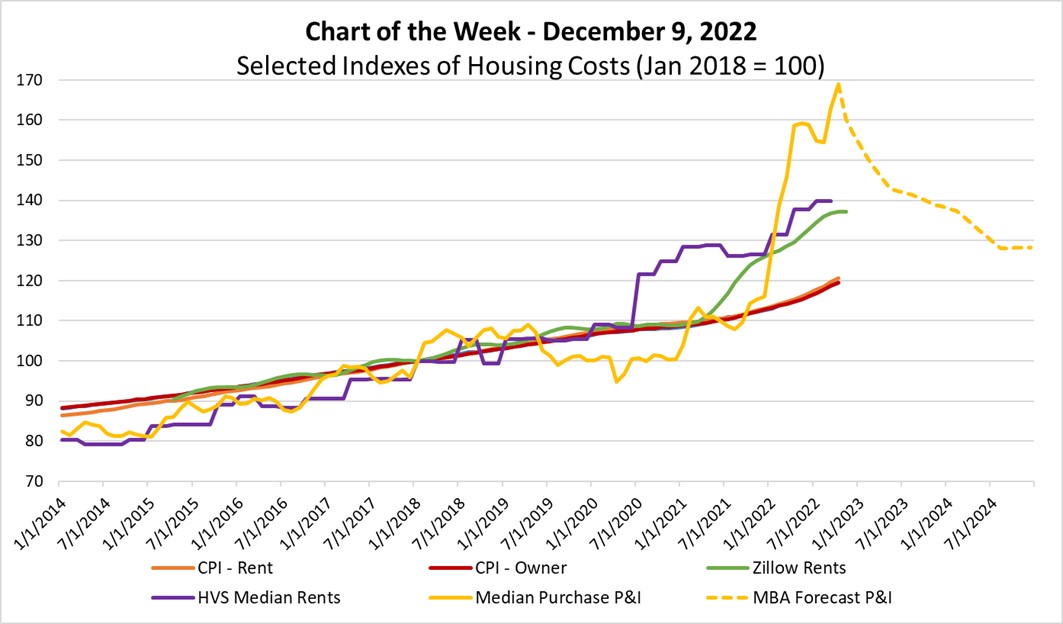

Chart of the Week: Select Indexes of Housing Costs

Chart of the Week: Select Indexes of Housing CostsHousing costs are – appropriately – getting a lot of attention. Part of that attention stems from affordability challenges heightened by recent rapid increases in home prices, interest rates, and rents. Another part stems from the fact that shelter costs are such a significant driver of measures of inflation, and thus a key motivator of Federal Reserve policies. In this week’s Chart of the Week, we examine selected indices of housing costs. Until recently, various gauges of housing costs moved more or less in unison. These include: a) Asking rents, like those tracked by Zillow and the Housing Vacancy Survey (HVS), b) In-place rents, like those followed by the consumer price index (CPI) for rents and for owners’ equivalent rents (OER), and c) Mortgage principal and interests (P&I) payments, like those tracked by MBA’s Purchase Application Payment Index (PAPI).

-

MBA Now with Jamie Woodwell

MBA Now with Jamie Woodwell on Commercial/Multifamily Market Conditions, Office White Paper, and MBA's CREF23.

-

2022 Q2 Quarterly Databook

Commercial and multifamily real estate sits at the confluence of three distinct markets – space, equity and debt – all three of which are going through significant transitions, as is the U.S. economy as a whole. The second quarter was the second consecutive quarter of negative growth in real gross domestic product (GDP). The 0.6 percent decline followed a 1.6 percent drop in Q1. While two consecutive quarters of drops in GDP are often seen as a sign of recession, the Q1 decline was driven by weakness in net exports and inventories – neither of which appeared to show fundamental weakness in the economy as a whole. Expectations are that Q3 will return to positive, although slow, growth.

-

MBA’s Commercial Real Estate Finance (CREF) Forecast

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $733 billion this year, down 18 percent from 2021 totals ($891 billion). This is according to an updated baseline forecast released July 19 by the Mortgage Bankers Association (MBA).

-

2022 Q1 Quarterly Databook

Commercial and multifamily real estate sits at the convergence of three markets – space, equity and debt. During the first quarter of 2022, space markets continued to move out of the shadow of the early days of the pandemic while property equity and debt markets continued the momentum from 2021. As we close out the second quarter (for which data will begin to become available in coming months) all three of the markets – space, equity and debt – are in states of significant transition. The information in this quarter’s Data Book largely reflects where markets were prior to the recent “resets.”

-

2020 Q4 Quarterly Databook

2020 Q4 Quarterly DatabookThe US economy continued to rebound during the fourth quarter of 2020 but did so at a slower pace than Q3 of 2020 or what is expected to be recorded in Q1 2021.

-

A Post-Pandemic World: Getting from Here to There -- Trepp Year-end Magazine

A Post-Pandemic World: Getting from Here to There -- Trepp Year-end MagazineWhen the Covid-19 pandemic hit the United States in March, it raised two fundamental questions for owners, lenders and others involved in commercial real estate: a) How would properties get through the pandemic and recession and b) What would the "new normal" be for the sector post-pandemic? One thing became crystal clear early on - the answers to those two questions would vary dramatically by property type.