Chart of the Week: Multifamily - Rents Reverting

The pandemic did a number on the housing market.

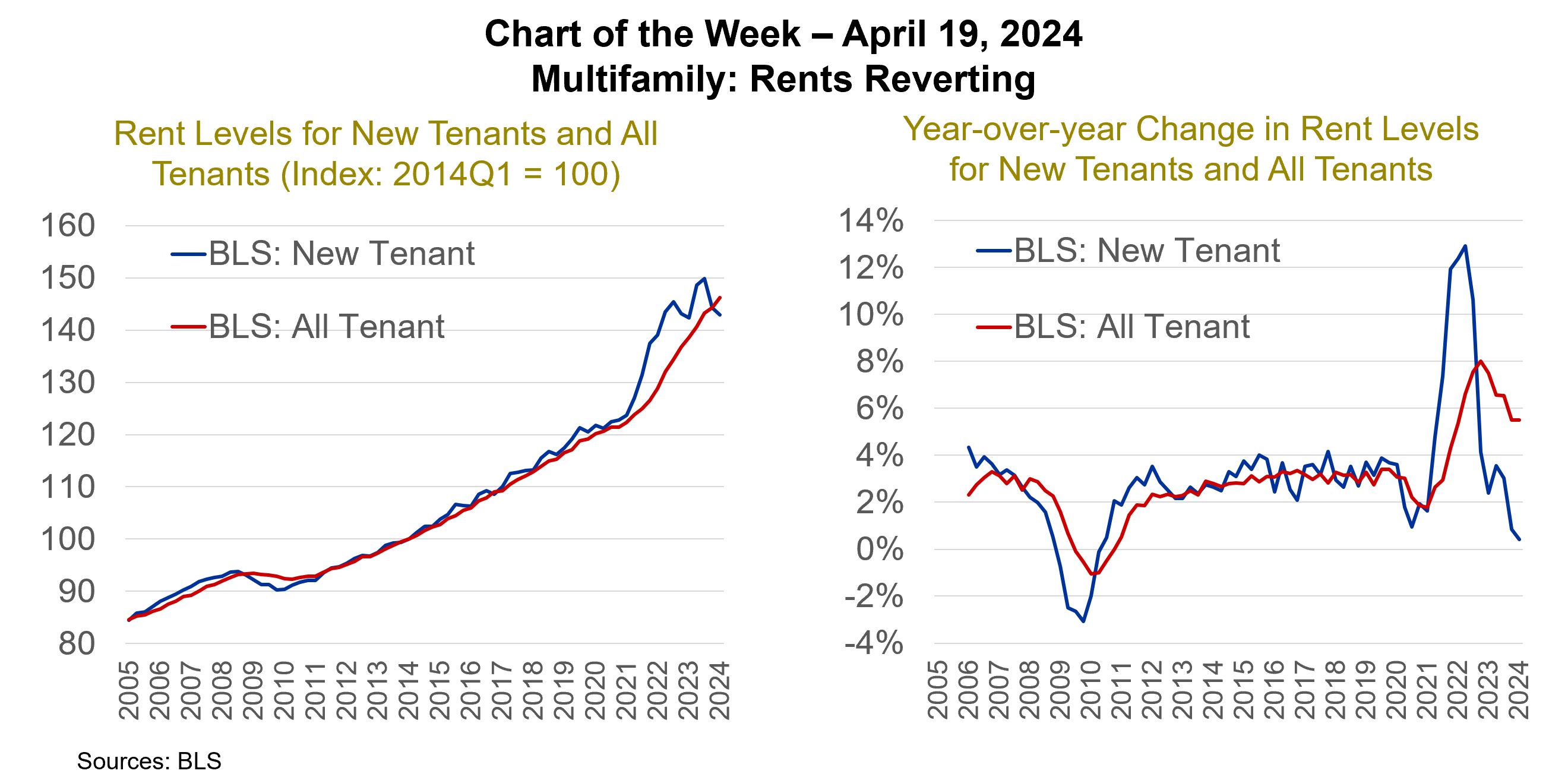

Rental markets were already stretched from years of underdevelopment that followed the Great Financial Crisis, while a surge of Millennials was just entering their formative renting years. The result was falling multifamily vacancy rates, which dropped from an all-time high of 13.1 percent at the end of 2009 to 7.0 percent at the end of 2015. Rents followed suit, rising steadily between 2 and 4 percent per year from 2012 to 2020.

Federal data gets a bit unreliable at the onset of the pandemic – with researchers and respondents avoiding in-person contact and working remotely — but as the pandemic went on it became clear that another shift was taking place. New tenant rents, which track the rent of a unit that changes from one tenant to another, had grown by 2.7 percent in 2018, 3.2 percent in 2019 and 1.9 percent in 2020. In 2021, they increased by 11.9 percent. Looking across all renter households, not just units with a change in tenants, rents lagged and grew at a slower pace but still rose 8.0 percent in 2022. Prices across all items tracked by the Bureau of Labor Statistics rose 7.0 percent in 2021 and 6.5 percent in 2022.

A lot has changed. The surge in pandemic incomes has waned. The mass internal migration that the pandemic spawned has slowed. The surge of millennials entering prime renting years has passed. A surge of new construction is hitting the market.

The rise in new tenant rents that presaged the broader rise fell from 11.9 percent in 2021 to 4.1 percent in 2022 to 0.9 percent in 2023. The lagging measure of rent for all tenants has fallen from 8.0 percent in 2022 to 5.5 percent in 2023. In a marked change from recent years, with declines in new tenant rents each of the last two quarters, apartment turnovers are now exerting downward, rather than upward, pressure on rents.