Mortgage Application Payments Decreased in July

“Affordability conditions have now improved for two consecutive months, the result of lower mortgage rates and continued strong income growth,” said Edward Seiler, MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “MBA is forecasting that mortgage rates will remain in the 6.5 percent to 7 percent range for the rest of 2025. While still elevated, continued income growth and softening home-price gains should boost prospective buyers’ purchasing power in the months ahead.”

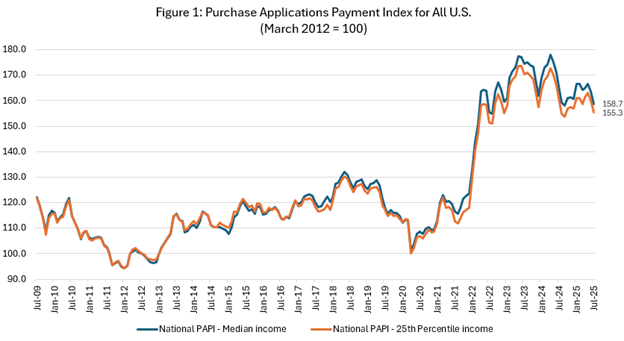

An increase in MBA’s PAPI – indicative of declining borrower affordability conditions – means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI – indicative of improving borrower affordability conditions – occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI (Figure 1) decreased 3.0 percent to 158.7 in July from 163.7 in June. Median earnings were up 3.7 percent compared to one year ago, and while payments decreased 0.6 percent, the significant earnings growth means that the PAPI is down (affordability is higher) 4.1 percent on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,468 in July from $1,500 in June.

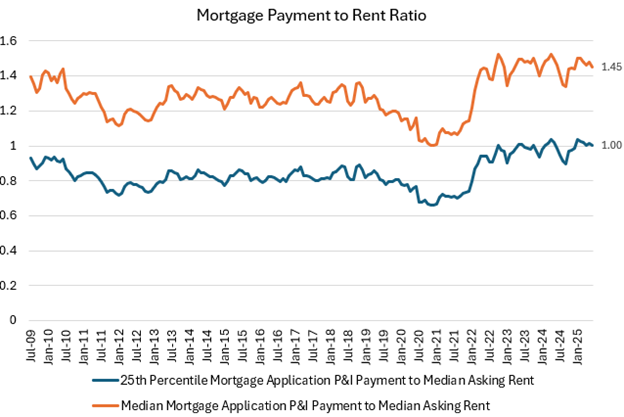

MBA’s national mortgage payment to rent ratio (MPRR) decreased from 1.48 at the end of the first quarter (March 2025) to 1.45 at the end of the second quarter (June 2025), meaning mortgage payments for home purchases have decreased relative to rents. The Census Bureau’s HVS national median asking rent in the second-quarter 2025 increased to $1,494 ($1,468 in first-quarter 2025). The 25th percentile mortgage application payment to median asking rent ratio decreased to 1.00 in June (1.02 in March 2025).

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased to $2,233 in July from $2,273 in June.

Additional Key Findings of MBA's Purchase Applications Payment Index (PAPI) – July 2025

- The national median mortgage payment was $2,127 in July 2025 — down $45 from June. It was down by $13 from one year ago, equal to a 0.6% decrease.

- The national median mortgage payment for FHA loan applicants was $1,865 in July, down from $1, 881 in June but up from $1,838 in July 2024.

- The national median mortgage payment for conventional loan applicants was $2,160, down from $2,205 in June but up from $2,140 in July 2024.

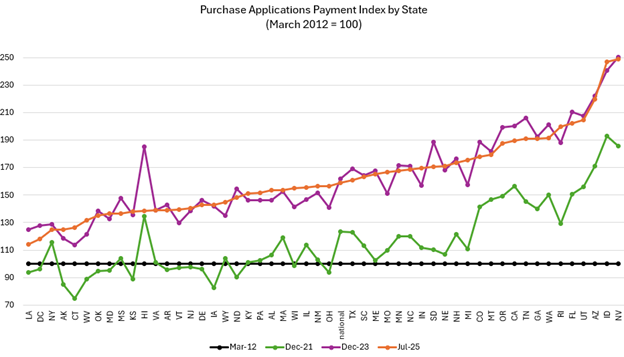

- The top five states with the highest PAPI were: Nevada (248.9), Idaho (247.0), Arizona (219.7), Utah (204.7), and Florida (202.3).

- The top five states with the lowest PAPI were: Louisiana (114.4), D.C. (118.1), New York (124.9), Alaska (125.0), and Connecticut (126.4).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 163.1 in June to 158.2 in July.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 152.4 in June to 147.8 in July.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 164.8 in June to 159.8 in July.

About MBA’s Purchase Applications Payment Index