National Delinquency Survey

The National Delinquency Survey (NDS) is one of the most recognized sources for residential mortgage delinquency and foreclosure rates. Based on a sample of almost 40 million first lien loans reported by servicers including independent mortgage banks

and depositories such as large banks, community banks, and credit unions, NDS provides quarterly delinquency and foreclosure statistics at the national, regional and state levels.

Delinquency and foreclosure measures are broken out into

the following 8 loan types: All loans aggregated, Conventional, Conventional Fixed, Conventional ARM, FHA, FHA Fixed, FHA ARM and VA loans. At each geographic classification, there are 7 measures provided as percentages: total delinquencies,

delinquency by past due category (30-59 days, 60-89 days and 90 days and over), new foreclosures starts, foreclosure inventory, and seriously delinquent. The total number of loans serviced each quarter is also included in the data. Download a sample report.

For more information on this product, read our FAQs or email [email protected].

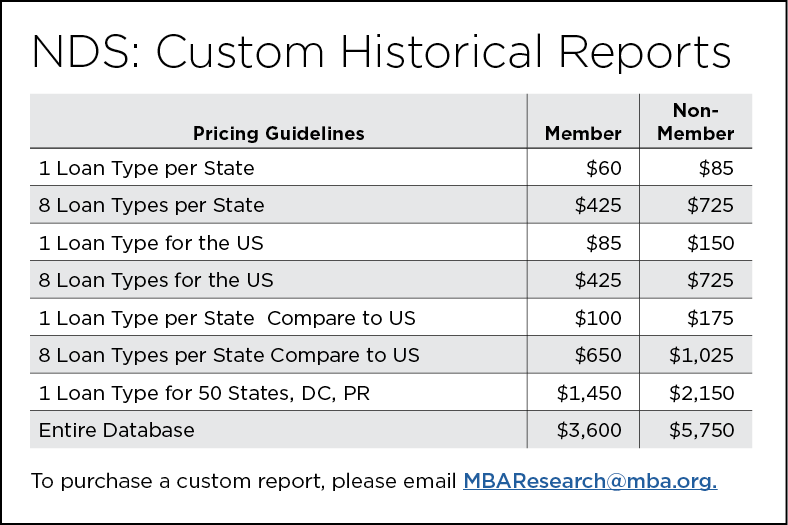

Purchase National Delinquency Survey (NDS) Historical Reports

-

NATIONAL DELINQUENCY SURVEY: Single User Subscription

-

2025 Q3 U.S. (Aggregate) Historical Delinquency & Foreclosure Rates

-

2025 Q3 Recent Foreclosure Trends Report for all States

-

2025 Q3 Recent Delinquency Trends Report for all States

-

2025 Q3 National Delinquency Survey Origination Year Data: Vintage Curves by Product Type

-

2025 Q3 National Delinquency Survey - All Data Points

-

2025 Q3 National Delinquency Survey

-

2025 Q2 U.S. (Aggregate) Historical Delinquency & Foreclosure Rates

-

2025 Q2 Recent Foreclosure Trends Report for all States

-

2025 Q2 Recent Delinquency Trends Report for all States

-

2025 Q2 National Delinquency Survey Origination Year Data: Vintage Curves by Product Type

-

2025 Q2 National Delinquency Survey - All Data Points

-

2025 Q2 National Delinquency Survey

-

2025 Q1 U.S. (Aggregate) Historical Delinquency & Foreclosure Rates

-

2025 Q1 Recent Foreclosure Trends Report for all States

Related Press Releases

-

Mortgage Delinquencies Increase in the Third Quarter of 2025

-

Mortgage Delinquencies Decrease Slightly in the Second Quarter of 2025

-

Mortgage Delinquencies Increase Slightly in the First Quarter of 2025

-

Mortgage Delinquencies Increase in the Fourth Quarter of 2024

-

Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

-

Mortgage Delinquencies Increase in the Second Quarter of 2024

-

Mortgage Delinquencies Increase Slightly in the First Quarter of 2024

-

Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth Quarter 2023

-

Mortgage Delinquencies Increase in the Fourth Quarter of 2023

-

Mortgage Delinquency Rate in First-Quarter 2023 Declines to Second-Lowest Level in MBA’s Survey