Mortgage Credit Availability Index

Complimentary for MBA Members! The Mortgage Credit Availability Index (MCAI) is a barometer on the availability or supply of mortgage credit at a point in time, using criteria from institutional investors who purchase loans through the broker and/or correspondent channels. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) using data made available by ICE Mortgage Technology. These metrics and the underwriting criteria for numerous lenders/investors are analyzed and, through a proprietary formula, MBA calculates the MCAI which include indices for Total, Conventional, Government, Conforming and Jumbo segments. The base period and values for the total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

Questions about MBA Research? Contact the MBA Research team.

Questions about ICE Mortgage Technology? Visit their website.

Related Press Releases

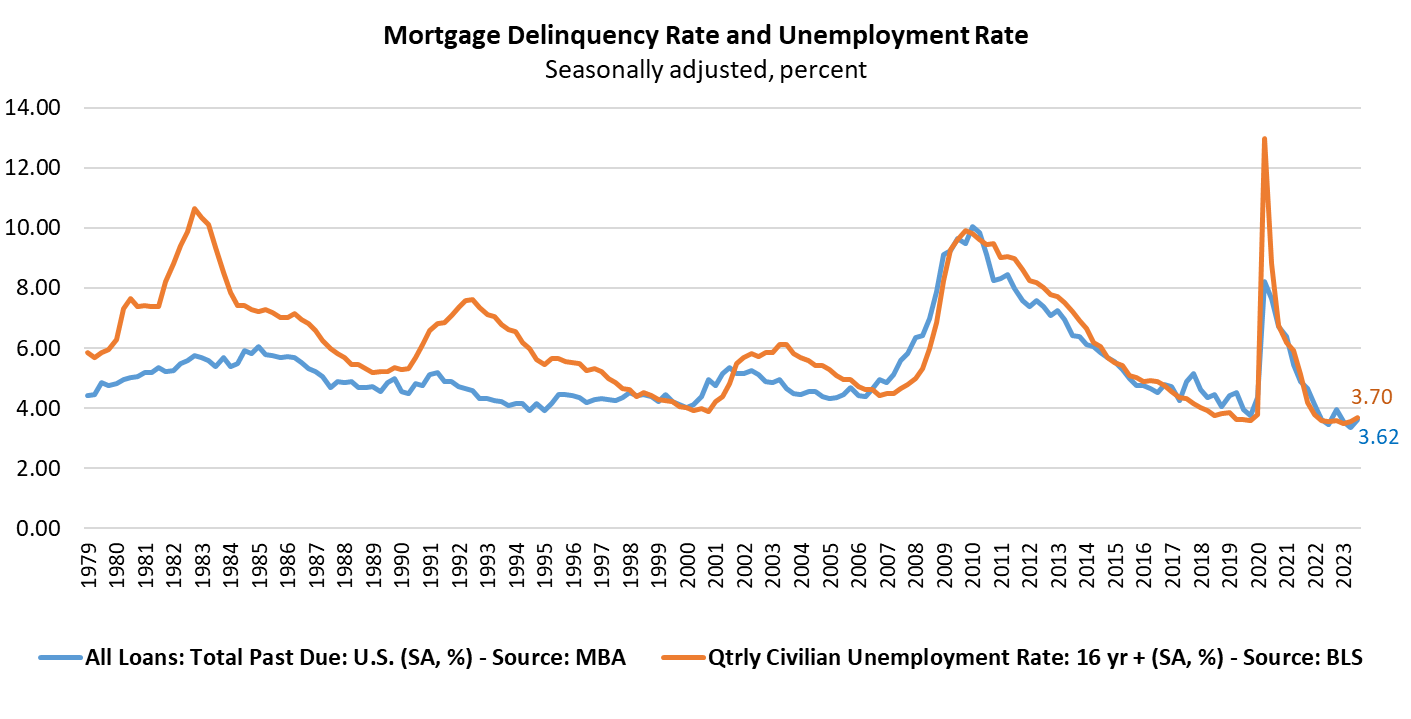

Mortgage Delinquencies Increase in the Third Quarter of 2023

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased 28 basis points to 2.03 percent, the 60-day delinquency rate increased 7 basis points to 0.62 percent, and the 90-day delinquency bucket decreased 9 basis points to 0.98 percent.

- By loan type, the total delinquency rate for conventional loans increased 21 basis points to 2.50 percent over the previous quarter. The FHA delinquency rate increased 55 basis points to 9.50 percent, and the VA delinquency rate increased by 6 basis points to 3.76 percent.

- On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate decreased by 2 basis points for conventional loans, increased 98 basis points for FHA loans, and increased 5 basis points for VA loans from the previous year.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.49 percent, down 4 basis points from the second quarter of 2023 and down 7 basis points lower than one year ago. This is the lowest foreclosure inventory rate since fourth-quarter 2021.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.52 percent, the lowest level since 1984. It decreased by 9 basis points from last quarter and decreased by 38 basis points from last year. The seriously delinquent rate decreased 5 basis points for conventional loans, decreased 37 basis points for FHA loans, and decreased 16 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 31 basis points for conventional loans, decreased 92 basis points for FHA loans, and decreased 52 basis points for VA loans.

- The five states with the largest quarterly increases in their overall delinquency rate were: South Dakota (124 basis points), New Mexico (61 basis points), Hawaii (54 basis points), Mississippi (49 basis points), and Louisiana (49 basis points).

Leave a comment