August New Home Purchase Mortgage Applications Increased 20.6 Percent

September 14, 2023

Share to

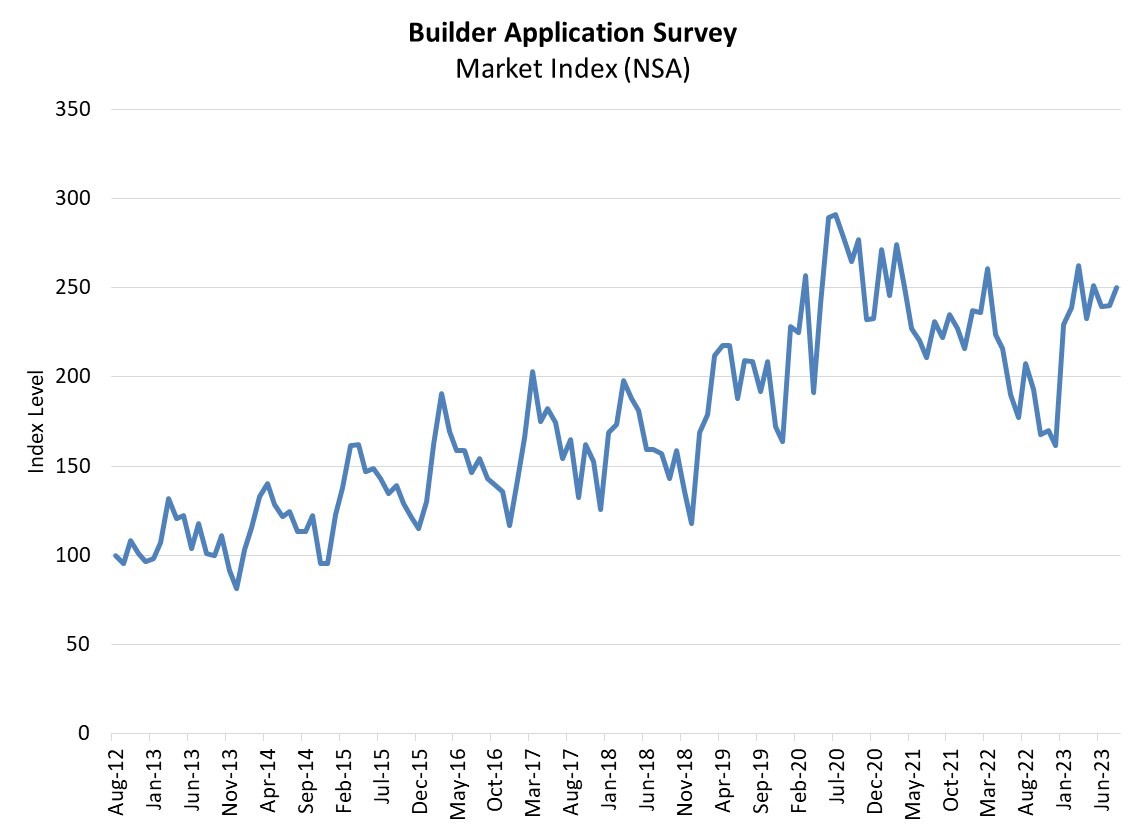

WASHINGTON, D.C. (September 14, 2023) – The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for August 2023 shows mortgage applications for new home purchases increased 20.6 percent compared from a year ago. Compared to July 2023, applications increased by 4 percent. This change does not include any adjustment for typical seasonal patterns.

“There was strong purchase demand in August for newly constructed homes, as existing for-sale inventory remains low with most homeowners locked into lower mortgage rates and unwilling to give those rates up in this higher rate market,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Despite the 30-year fixed rate averaging over 7 percent in August, applications for new home purchase loans increased over the month and from a year ago.”

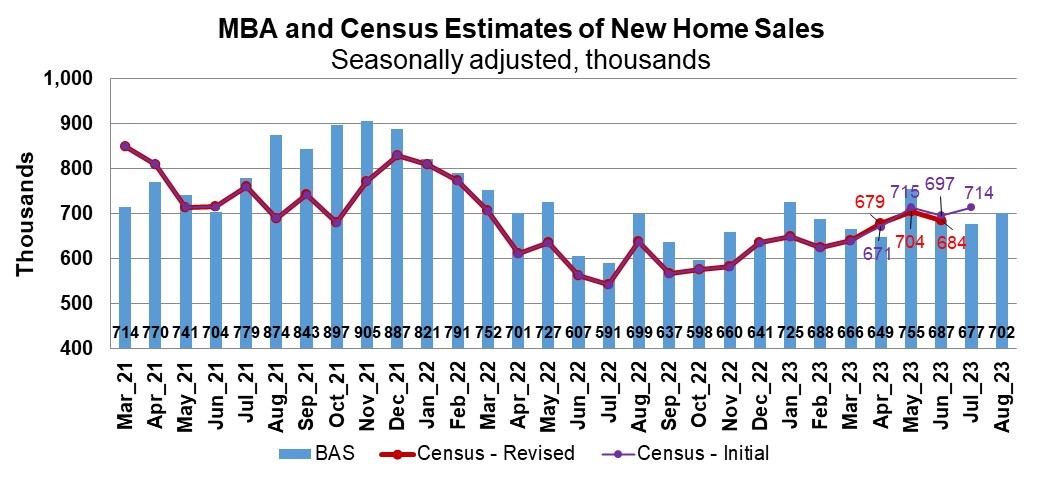

Added Kan, “The FHA share of applications dipped slightly in August but remains close to survey highs, indicating that a larger share of first-time homebuyers is supporting the new home sales market. Our estimate of new home sales showed a 4 percent increase to the strongest pace of sales in three months at 702,000 units.”

MBA estimates new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 702,000 units in August 2023. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for August is an increase of 3.7 percent from the July pace of 677,000 units. On an unadjusted basis, MBA estimates that there were 59,000 new home sales in August 2023, an increase of 5.4 percent from 56,000 new home sales in July.

By product type, conventional loans composed 65.8 percent of loan applications, FHA loans composed 23.8 percent, RHS/USDA loans composed 0.2 percent and VA loans composed 10.2 percent. The average loan size for new homes increased from $397,148 in July to $398,092 in August.

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro levels. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information on MBA’s Builder Application Survey, please click here.