Mortgage Credit Availability Index

Complimentary for MBA Members! The Mortgage Credit Availability Index (MCAI) is a barometer on the availability or supply of mortgage credit at a point in time, using criteria from institutional investors who purchase loans through the broker and/or correspondent channels. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) using data made available by ICE Mortgage Technology. These metrics and the underwriting criteria for numerous lenders/investors are analyzed and, through a proprietary formula, MBA calculates the MCAI which include indices for Total, Conventional, Government, Conforming and Jumbo segments. The base period and values for the total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

Questions about MBA Research? Contact the MBA Research team.

Questions about ICE Mortgage Technology? Visit their website.

Related Press Releases

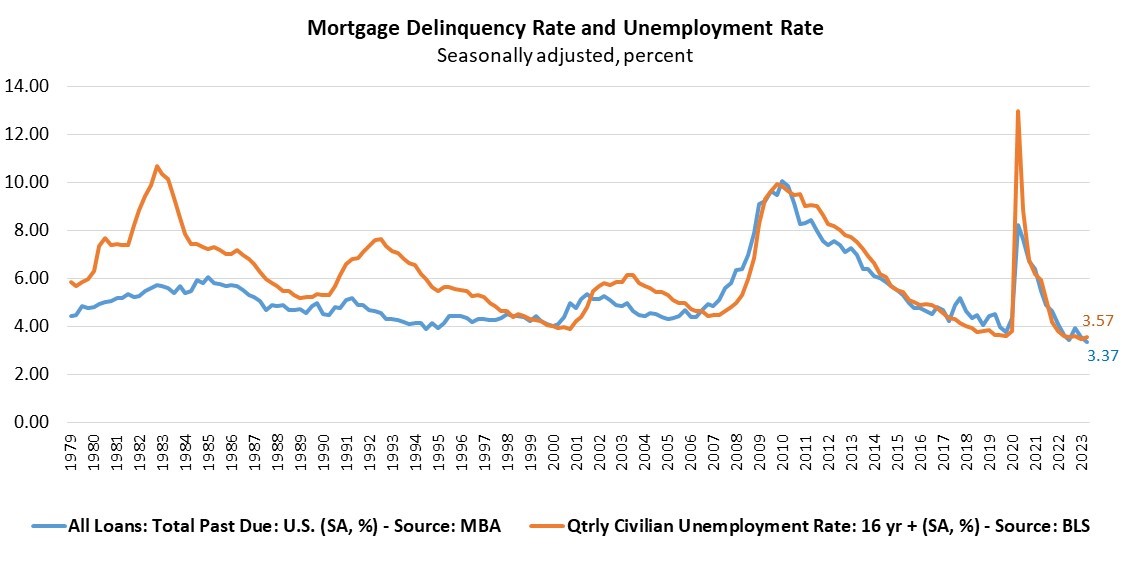

Mortgage Delinquencies Decrease in the Second Quarter of 2023

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 2 basis points to 1.75 percent, the 60-day delinquency rate remained unchanged at 0.55 percent, and the 90-day delinquency bucket decreased 17 basis points to 1.07 percent.

- By loan type, the total delinquency rate for conventional loans decreased 15 basis points to 2.29 percent over the previous quarter to the lowest level in the history of the survey dating back to 2004. The FHA delinquency rate decreased 32 basis points to 8.95 percent, and the VA delinquency rate decreased by 28 basis points to 3.70 percent over the previous quarter to the lowest level since the fourth quarter of 2019.

- On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 35 basis points for conventional loans, increased 10 basis points for FHA loans and decreased 52 basis points for VA loans from the previous year.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.53 percent, down 4 basis points from the first quarter of 2023 and 6 basis points lower than one year ago.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.61 percent, the lowest level since the second quarter of 2000. It decreased by 12 basis points from last quarter and decreased by 51 basis points from last year. The seriously delinquent rate decreased 10 basis points for conventional loans, decreased 30 basis points for FHA loans, and decreased 11 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 44 basis points for conventional loans, decreased 93 basis points for FHA loans and decreased 68 basis points for VA loans.

- The five states with the largest quarterly increases in their overall non-seasonally adjusted delinquency rate were: Indiana (37 basis points), Michigan (35 basis points), Ohio (35 basis points), Pennsylvania (32 basis points), and Texas (31 basis points).

- Note: For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

Leave a comment