Mortgage Credit Availability Index

Complimentary for MBA Members! The Mortgage Credit Availability Index (MCAI) is a barometer on the availability or supply of mortgage credit at a point in time, using criteria from institutional investors who purchase loans through the broker and/or correspondent channels. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) using data made available by ICE Mortgage Technology. These metrics and the underwriting criteria for numerous lenders/investors are analyzed and, through a proprietary formula, MBA calculates the MCAI which include indices for Total, Conventional, Government, Conforming and Jumbo segments. The base period and values for the total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

Questions about MBA Research? Contact the MBA Research team.

Questions about ICE Mortgage Technology? Visit their website.

Related Press Releases

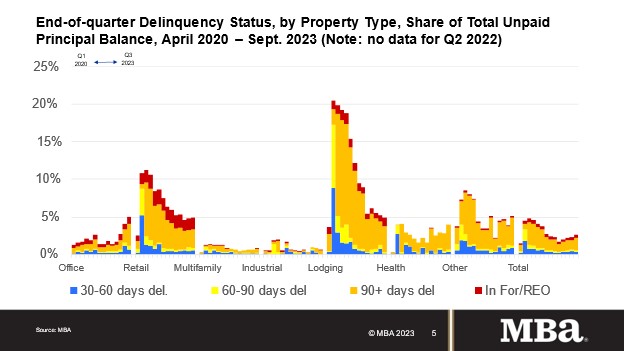

Commercial and Multifamily Mortgage Delinquency Rates Increased Slightly in Third-Quarter 2023

The balance of commercial and multifamily mortgages that are not current increased in September 2023 (compared to June 2023).

- 97.3% of outstanding loan balances were current or less than 30 days late at the end of the third quarter, down from 97.7% at the end of the second quarter of 2023.

- 2.2% were 90+ days delinquent or in REO, up from 1.7% the previous quarter.

- 0.2% were 60-90 days delinquent, unchanged from the previous quarter.

- 0.3% were 30-60 days delinquent, down from 0.4%.

- Loans backed by office properties drove the increase.

- 5.1% of the balance of office property loans were delinquent, up from 4.0% at the end of last quarter.

- 5.0% of the balance of retail loan balances were delinquent, up from 4.9%.

- 4.9% of the balance of lodging loans were 30 days or more delinquent, down from 5.3%.

- 0.9% of multifamily balances were delinquent, up from 0.7%.

- 0.6% of the balance of industrial property loans were delinquent, down from 0.8%.

- Among capital sources, CMBS loan delinquency rates saw the highest levels.

- 4.4% of CMBS loan balances were 30 days or more delinquent, up from 4.1% last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.8% of FHA multifamily and health care loan balances were 30 days or more delinquent, unchanged from last quarter.

- 0.7% of life company loan balances were delinquent, up from 0.4%.

- 0.4% of GSE loan balances were delinquent, up from 0.3%.

Leave a comment